Cross-Cutting

Entrepreneurship

Boost entrepreneurship, with a focus on Black-and brown-owned small businesses

Erie has been the subject of considerable investment in recent years by its downtown anchors, including UPMC, Erie Insurance, and Gannon University. These investments are creating economic growth and opportunities for small-and medium-sized businesses to “fill in” needs created by increased demand in the region. However, many residents within Erie lack the skills, relationships, and capital to start businesses. This problem is especially acute among Erie’s Black residents, immigrants, and other residents of color. Given the heightened demand for local business services and products, Erie has a unique opportunity to push considerable resources to this issue in the form of startup grants and funds, technical assistance, and local procurement efforts to ensure a broader set of Erie residents benefit from this new chapter in Erie’s economy.

2.1: Expand quality coaching for BIPOC businesses by expanding entrepreneurial support

![]()

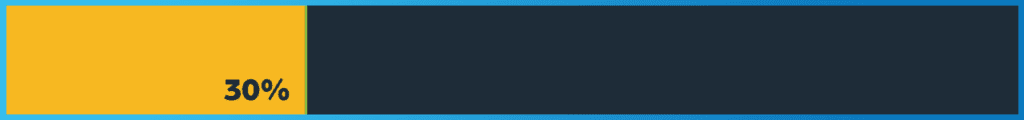

Investment Overview:

Erie, like most cities in the US, faces an enormous problem of racial inequity. Black residents in Erie face lower rates of homeownership, lower educational attainment, and higher rates of poverty than their white counterparts. Organizations like Paramount Pursuits and Erie Black Wall Street step in to fill crucial gaps in knowledge for Erie’s Black residents and provide training on issues such as introduction to entrepreneurship, growing a businesses, credit improvement, budgeting, and homeownership. The entrepreneurship training will have a separate program focused specifically on building and growing a business in construction and real estate development, in order to ensure that the spurt of real estate development in Erie also benefits its Black and brown residents.

![]()

Goals and Benefits:

Increasing funding for Paramount Pursuits and EBWS would have multiple levels of benefits. By increasing programming, the organizations could increase financial literacy, business starts, and homeownership. In doing so, this investment could also increase Black wealth and civic engagement among Black residents.

![]()

Relevant Examples:

WePower(St. Louis) combines advocacy and trainings for workforce and wealth building for communities of color

Jumpstart Germantown (Philadelphia) is a residential real estate development training program that focuses on helping people break into the industry and fighting gentrification by encouraging people to develop their own communities.

East Side Avenues Initiative (Buffalo) has a community-based real estate development training to train building owners in commercial real estate development and invest in community-level developer commercial and mixed-use projects, in order to ensure that buildings are redeveloped for and by East Side residents. The effort is funded with a $5M in capital and $1M operating budget.

![]()

Cost, Sources, and Uses:

Total cost: $1.5M (over 3 years)

Sources:

Future BBB RC programs, City and State ARPA funds

$200k –City ARP (EBWS)

$360k –City ARP (PP)

TBD–MBDA, local philanthropic capital

Uses:

$750k –salaries, programming, and other operating costs (EBWS)

$781k –total program cost (Paramount Pursuits)

![]()

Progress and Next Steps:

Progress to Date:

Secure initial funding from City ARP funds

Hold initial collaboration meetings between Paramount Pursuits and Erie Black Wall Street

Next Steps:

Secure additional funding to ensure programs can meet local demand

Begin implementation of construction / developer programs ASAP so that participants can benefit from construction boom

Solidify additional partnerships (e.g., with Bridgeway Capital)

2.2: Provide quality capital for Erie small businesses that is fit to purpose (More organizing required)

![]()

Investment Overview:

Using the US Treasury’s State Small Business Credit Initiative, Erie can provide substantial capital and technical assistance for its small businesses. Bridgeway Capital and Ben Franklin Technology Partners plan to invest in Erie County. Bridgeway plans to provide at least $15m in loans annually for 5 years, including many loans between $10,000 and $50,000. While these loans would be spread across a 15-county focus area, Bridgeway would ensure that at least a proportional amount of those loans are directed to businesses in Erie. Bridgeway and Ben Franklin could also work with other entrepreneurial support organizations, including:

Erie Black Wall Street to create a pipeline of businesses ready for investment

Erie Center for the Arts and Technology (ECAT) on a Creative Business Accelerator

![]()

Goals and Benefits:

Leveraging SSBCI funding for Erie businesses could result in almost $75M of investment, which would be tailored to local needs through important local partnerships and matched with technical assistance to ensure borrowers have access to capital and can grow and benefit from investment. Moreover, the funds would be structured with credit enhancements or other products to ensure they support businesses that may otherwise not have access to quality capital.

![]()

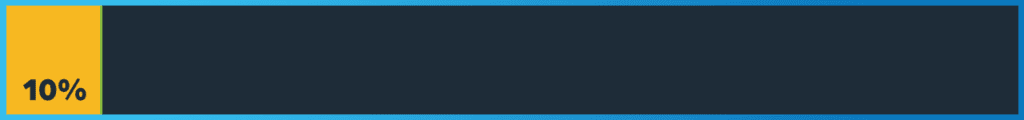

Cost, Sources, and Uses:

Total cost: TBD (over 5 years)

Sources:

$75M –SSBCI funding (Bridgeway)

TBD–SSBCI funding (Ben Franklin)

Users: TBD

![]()

Progress and Next Steps:

- Determine size and structure of funds from Bridgeway and Ben Franklin

- Formalize partnerships with EBWS, ECAT, and Paramount Pursuits for coaching

- Secure private match funding (at least 1:1 required)

- Build pipeline of potential investments with local partners

2.3: Establish Supply Erie to direct more procurement to local Erie businesses (More organizing required)

![]()

Investment Overview:

With the enactment of the $1.2 trillion Bipartisan Infrastructure Framework, Erie has a remarkable opportunity to harness federal investments to rebuild and diversify its small business economy. We recommend a new Supply Erie Initiative, designed to steer a substantial volume of federal infrastructure dollars to support, strengthen and grow local Black-and brown-owned businesses. The Initiative would work with a broad array of infrastructure agencies in Erie to (a) harmonize procurement definitions and practices across all public entities in the service of business equity; (b) ensure that potential vendors get the business coaching and quality capital they need to meet procurement demand; and (c) bring transparency in goal setting and reporting across multiple infrastructure agencies. The total platform funding for these efforts is estimated at $6-8 million over 4 years.

![]()

Goals and Benefits:

A Supply Erie program would increase demand for business services in Erie, giving an important advantage to local small-and medium-sized businesses during the critical early stages of their development. When matched with loans and technical assistance from the other investments in this category, Erie’s small businesses can receive the business, capital, and support they need to thrive in the long-term.

![]()

Relevant Examples:

Philadelphia Anchors for Growth and increases local purchasing by large institutional buyers to grow Philadelphia businesses, strengthen the local economy, create jobs, and build wealth

![]()

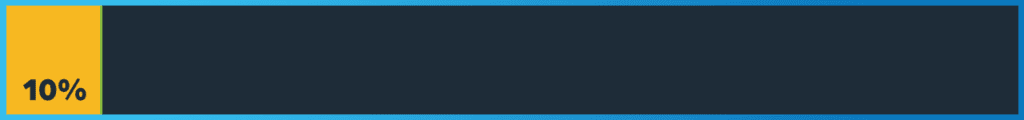

Cost, Sources, and Uses:

Total cost: $7,000,000 (estimate)

Sources: TBD

Uses: TBD

![]()

Progress and Next Steps:

- Obtain commitments from anchor institutions to hit local supply targets

- Raise funding for buy local campaign

- Determine other next steps